For long, the DXY has pounded fear across financial markets due to its dominance, weighting and influence over risk assets, emerging economics and those countries whom are reliant on the pegging mechanics of currency assignment! Without doubt – the “Issue of Currency should be protected by domination of Wall Street” and it is on this premise that I articulate my views herewith!

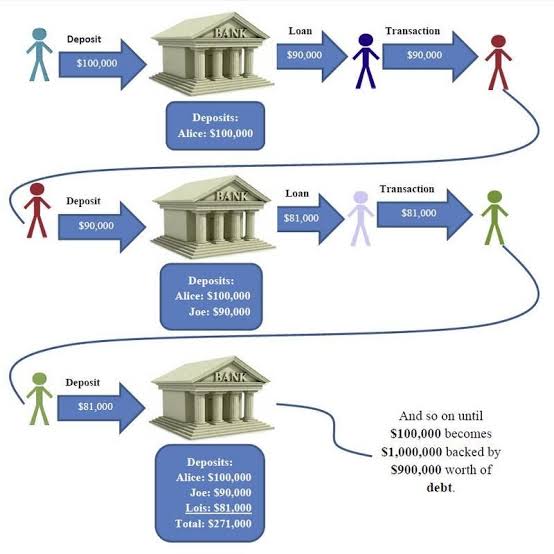

The fractional banking system that pervades the American banking system is nothing but servant, fueling the archaic policies that were omnipresent through the great depression and manifested in what America calls a tool to drive the American dream! What is robust when it does nothing but superficially articulate numbers showing 100x more multiplied reserves that is in a constant stream of bad debt, liquidity issues and beauracratic manipulation that does nothing but inspire corruption and which was the nexus of the subprime crisis (let alone the fact that this ‘money machine’ destroyed 30 million real jobs and destroyed over $16 trillion in household debt that ultimately impacted over 1 million homes in foreclosure!

In a poignant HBR article entitled “The Price of WallStreets Power”, the authors allude to an IMF study that “found that once a country’s financial sector becomes too large, it actually inhibits growth and increases volatility” [which ultimately] leads to “resource misallocation” as this is simply distributive in nature (opposed to creative. This not only compounds the need for this dominance of the USD to be diminished, but augments the value propositions that are aligned with emerging growth markets and harnessing creativity and collective intelligence as a tool to fuel economic growth! Think about it – why should you have centralised control where everyone is at the mercy of the cotroller – it sounds completely suss!

So how can economies, government leaders of the future inspire but more so create framework to finally finish this sovereignty of what I will proudly call the shitcoin dollar? For starters – regulators need to work with central banks and re-define the Base III framework to enable these banks to hold dynamic reserves of a myriad of assets that were previously not accepted into the mainstream. Yes, I am talking about cryptocurrencies and the likes of novel financial instruments like islamic bonds, architecture, art – for beauty is not only in the eye of the beholder – but the knower! Few understand this! This is not limited though – the entire monetary policy system needs to be remodelled due to the endemic lags that are associated with interest rate transmission. These lags are allowing entities such as the Federal Reserve and SEC to manipulate markets and create massive amounts of distrust and divisions between the people and those in power. It is power after all, that corrupts absolutely! Go figure!

TO BE CONTINUED! Ive got guests over – and its rude to stay on the ipad. Mind you – I have a wide arsenal of notes and am able to put them together. So do comment your views. I appreciate them!

IST 752PM

#thealphaswarmer

Banking establishments are more dangerous than standing armies!